2024 Iowa W-4 Tax Changes

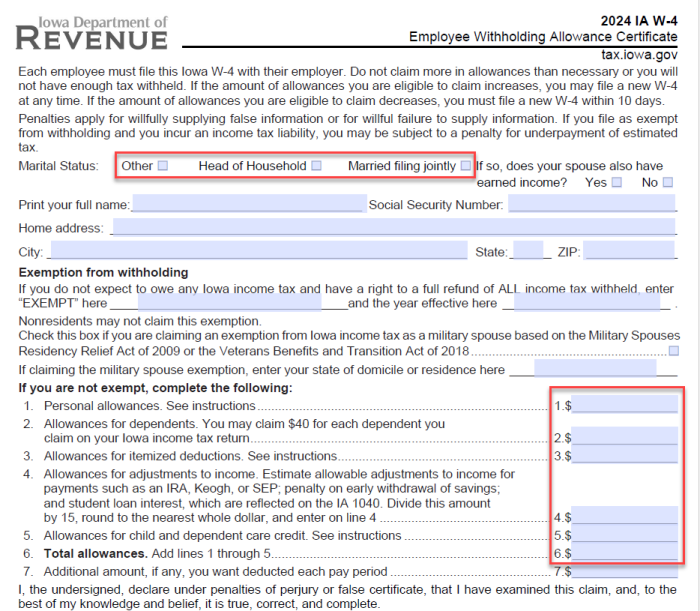

The Iowa W-4 has changed for 2024. Withholding statuses have been updated, and allowances are based on dollar amounts instead of numbers:

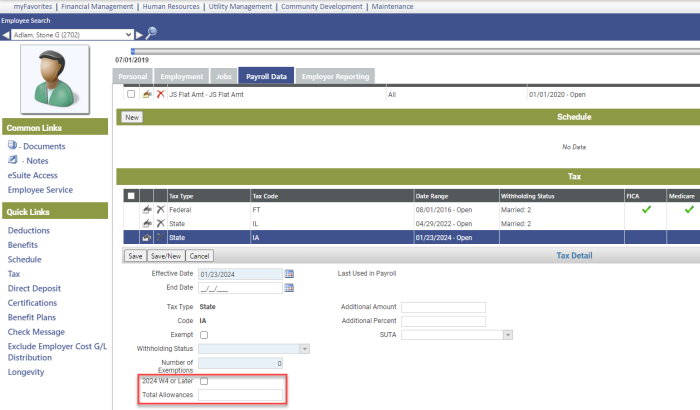

To accommodate these changes, a 2024 W4 or Later checkbox and a Total Allowances field have been added to the Tax Detail section of the Payroll Data tab in Workforce Administration:

Human Resources > Workforce Administration > Search > Employee Number > Payroll Data Tab > Tax

If an employee has submitted a W-4 for 2024 or later, mark the 2024 W4 or Later checkbox, and fill in the dollar amount of Total Allowances from line 6 of the W-4. This amount is the tax credit amount. If the 2024 W4 or Later checkbox is marked, an entry in the Number of Exemptions field is ignored in the tax calculation.

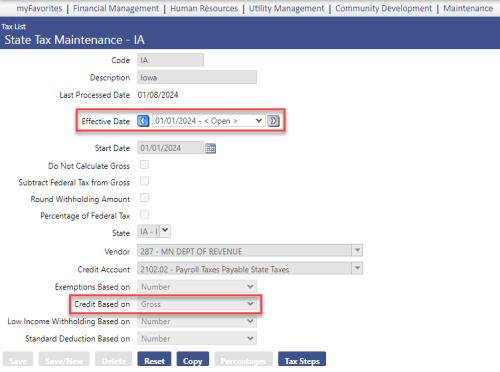

On the State Tax Maintenance page, tax credit before 2024 was based on number; in 2024, it is based on gross:

Maintenance > Human Resources > Deductions and Benefits > Taxes > IA State Tax Code

If an employee does not turn in an updated W-4 for 2024 or later, the withholding status and number of exemptions calculate as before.

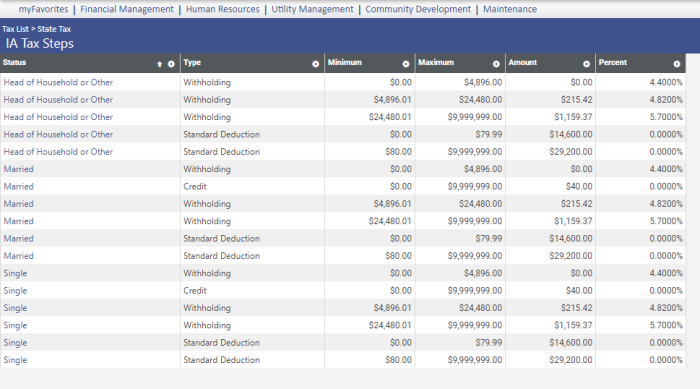

To be compliant with Iowa state regulations for employees who have not submitted a W-4 for 2024 or later, update the Tax Steps table as shown below:

Maintenance > Human Resources > Deductions and Benefits > Code IA > Tax Steps

The numbers for the Head of Household and Other withholding statuses are the same, so combine the statuses into one: Head of Household or Other. This status does not include a credit amount, since the credit amount equals the amount entered in the new Total Allowances field in Workforce.

Update the minimum and maximum allowance amounts and standard deduction amounts for single and married statuses. For total allowances of less than $80.00, use the standard deduction amount of $14,600.00. For total allowances of $80.00 or more, use the standard deduction of $29,200.00.